If you’re a regular reader of Bitcoin Basics, you likely already know that Bitcoin is the most scarce asset on Earth. That’s why it makes perfect sense for you to accumulate as much Bitcoin as possible while you’re still actively working—before retirement sneaks up. The sooner you start stacking, the better positioned you’ll be for financial freedom in the future.

They say that comparison is the thief of joy, but, the price of Bitcoin is up, and just doesn’t seem to ever want to come back down, so let’s have some fun.

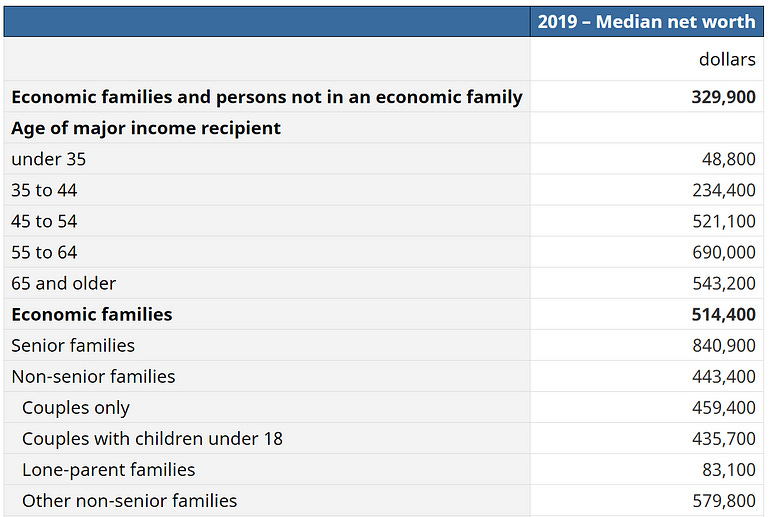

First things first, lets start by taking a look at the Median Family Net Worth by Age. Data from Statistics Canada has found that the average Economic Family, meaning the combination a Husband and a Wife in a working unit.

The first thing that is noticeable is that the median net worth under 35 years old seems very low. If it seems low to you, that is a good thing, it means that you are ahead of your peers. At a young age it is easiest to get ahead. As you get older it takes a lot more wealth to stay ahead.

The oldest generation have had the longest amount of time in the market to accumulate assets, they have bought their home and have since paid it off, they have reached the peak earning years of their careers. Most importantly, they’ve benefitted the most from the 8th Wonder of the World, compound growth.

Now, at this point in the article I should probably take a moment to describe the difference between a mean and a median value in statistics. To help explain the difference, I asked Bing AI for help:

“Median net worth is like the middle value when you line up everyone’s net worth from least to most. It’s the “middle-class” of net worth's. Mean net worth is the average, where you add up everyone’s net worth and divide by the number of people. It’s like that one rich friend who skews the bill at dinner.”

And with that, lets get to the part that you have all been waiting for.

Thanks for reading this far! Next up is an exclusive breakdown, available only to Bitcoin Basics members. Your support keeps our Bitcoin-only writing thriving—join now to unlock the full analysis!

If you are under 35 years old today, based on the median net worth of a working family, between you and your significant other, you should have roughly 0.5 Bitcoin at today’s current price of $100,000 per coin.

If you are between 35 and 45 years old, you and your partner should have at least 2 Bitcoin. I personally really like this number of Bitcoin. In my head, I see it as having saved one Bitcoin for each of you in the relationship. Humans love round numbers and unit biases, and believe me, there is nothing sweeter than 1 Bitcoin.

If you are between 45 and 54 you and your family should have saved between 2 and 3 Bitcoin. By this point in your life you may have a few teenagers running around your house. Think about those extra Bitcoin that you saved up in the last 10 years to be for them.

If you are 55–65, congratulations! You have worked a long and successful career and likely have much to show for it. Based on the median net worth of your cohort, you may have 4 to 5 Bitcoin. That is a lot.

These calculations assume a static price of Bitcoin at $100,000. These predictions start to get very fun when you start to extrapolate out the price of Bitcoin into the year 2030 and beyond.

What’s fascinating here is how these figures not only reflect different life stages but also hint at the power of starting early. The earlier you begin accumulating Bitcoin, the more you can benefit from potential price appreciation and the compound effect over time.

Even if the current estimates seem modest, as Bitcoin’s value increases, the impact on your net worth could be exponential. This perspective reinforces the idea that consistent, long-term investment—regardless of where you are in life—can serve as a hedge against inflation and a cornerstone for financial freedom.

Keep in mind that these numbers are based on Bitcoin's current price and economic environment. Thanks to Bitcoin's deflationary nature, its value is expected to rise over time, meaning you'll need fewer coins to secure the same financial position in the future.

My favorite part is that when I update this post next year, the target Bitcoin holdings for each age group will likely be lower!

Essentially, as Bitcoin appreciates, your accumulation targets shift, reinforcing the idea that starting early and investing consistently can pay off even more over time.

Hey everyone, thanks for reading. After writing this article I came up with one question, its an important one:

Would you feel comfortable holding your entire net worth in Bitcoin? Why or why not?